Trading update 2025

2025-08-02 17:17

I've just hit the two year mark of sticking with a single trading strategy (technically a portfolio of strategies, explained below). For me sticking with anything that long is pretty rare, let alone putting my money in the financial markets. Thought I'd ramble out a bit of an update.

Note: I am not an experienced trader or investor... simply a dabbler. Like most things on my site. Jack of all, master of none. You get the drift.

I've dabbled in trading and investing for a good 20 years now. I learnt about contracts for difference (CFDs) from dad's workmate around 2001, but CFDs still confuse the hell out of me (as do options). I went to a night course on investing, and been a member of the Australian Technical Analysis Association, attending a few of their monthly meetups in Sydney, and more recently been a member of the Society of Technical Analysis of New Zealand.

I lean towards trading more than investing because I like the technical bits and pieces. The endless learning of statistical calculations, looking at candlestick charts and crunching numbers. I'm terrible at it, but every now and then I write or read something that makes sense. I find the information out there fascinating to read. Especially around psychology of trading and systematic trading. Anything by Aronson, Carver, Douglas, Tharp and Schwager are fantastic reads..

I've played with software like MetaTrader and Amibroker. I bought a lifetime licence of Amibroker. I've written my own scripts in Amibroker Formula Language (AFL), and have built trading systems in them, backtested on years of data, and traded in my own accounts what those systems were telling me.

It was fun (it shouldn't be), and probably still would be if I picked it up again, but I can't be arsed. I was smart enough not to put all my moolah in and blow it all down the drain. My strategies were probably not great because no matter how many books on statistical analysis I got inspired by, I never fully grasped it, and never committed the time required, because it was always just a hobby and not much else. Even though a seed was planted in 2001, I didn't actually start to trade until I was incapacitated with a back injury in 2005 and suddenly found time on my hands. Again in the 2010s when I found myself in a moon boot, or flared the back up again. It is a good non-athletic fallback hobby. I was lucky to even have savings to put towards it. In the end, for a good 18 of the 20 years I've probably landed flat, which is better than most traders.

So what about those last 2 years? That's now. I've just hit 24 months trading a single strategy. I have not budged. I'm pretty proud of that. I really dig systematic trading. A lot of that is about building your system, and then sticking with it, not pulling out on the first wiff of a drawdown.

The strategy I am using is unfortunately not mine. I gave up on all that. I came to grips that I will not dedicate the time necessary to be a "successful trader". Sidenote: I never really defined exactly what my goal was. I mean, I did like the books told me, but my goalposts kept moving... they weren't defined properly. It was a weak effort

It has earnt me an unastronimcal annualised return of 8.48%. I'm pretty happy with that. It is more than the interest rate on my homeloan, and way above any savings account or fixed term cash deposits (note, I diversify so do have savings and fixed term cash deposits as well).

I am following Allocate Smartly's free tactical asset allocation Sample Model Portfolio #1. Allocate Smartly pull together a bunch of known strategies and give you the ability to combine them to form a portfolio in a way that suits your style. The beauty of Allocate Smartly is that you don't need any fancy tools like Amibroker or TradStation. They provide you with all the backtesting models and statistics on the fly as you build your portfolios. You can choose how often you want to trade (though most of the strategies are designed for monthly rotations), and you will be told what percentage allocations you need to adjust each month with your broker.

I'm not a paying member however, so have just skimmed off the free sample portfolio, which has served me well. My small capital didn't warrant the subscription, but I am considering it now. There is a good subreddit at r/AllocateSmartly with a wealth of information. Kevin, who ran the subreddit for years has recently stood down, but his posts are still there where he shares a great deal of information, spreadsheets and all.

Sample Model Portfolio #1, the absolute basic and free portfolio is made up of three strategies:

- Countercyclical Trend Following (20%)

- Faber's 12-Month High Switch (Dynamic Bond) (40%)

- Hybrid Asset Allocation - Simple (40%)

Overall the portfolio has moved my allocations across 14 different instruments, with the occasional cash holdings too. At most I'm placing 4 orders on the last day of the month, or rather first day of the month here NZT.

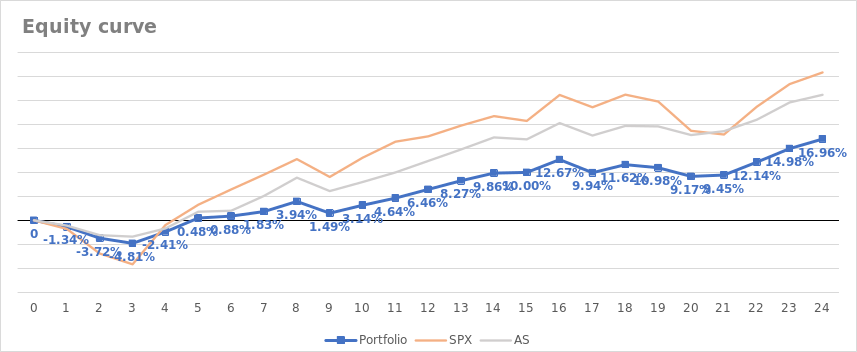

Here's a chart, showing my accumulated return, benchmarked against both the SPY index (SPX) and the actual system that I am trading:

A few things worth noting.

- Yep, I'm doing the worst out of the three in terms of accumulated return.

- The SPX has had a good run in this time period, but look at those dips - Month 3 could've scared me out of the market if I was solely in the SPX, same with months 20 and 21. My dips were there, but they weren't as extreme.

- The AS system did better than what I did - this is what I am following so why am I not the same? The AS strategy is based on the closing price at the end of the month. No matter how hard I try, I will not be able to put all my orders on at the close of the month. I'm trading the US market, and I am in NZ so that is usually around 8:30AM the day after, which is when I'm at work (unless it's a US Friday - Saturday here). This means I'm sometimes hours off the close, so many things can happen between that time, for better or worse. I also don't bother with changing allocation funds when it is less than 1% of my capital. My account is not big enough to warrant the trading fees. I've simply forgotten sometimes too, or wasn't aware of a US public holiday on the last day.

- I went straight into drawdown. Bad timing. That's just how it goes. I could've maybe built another strategy to decide when to start this strategy, but the whole reason I'm doing this is because I don't have that time or inclination. I was ready so just went for it.

- Returns include dividends(+) and transaction fees(-).

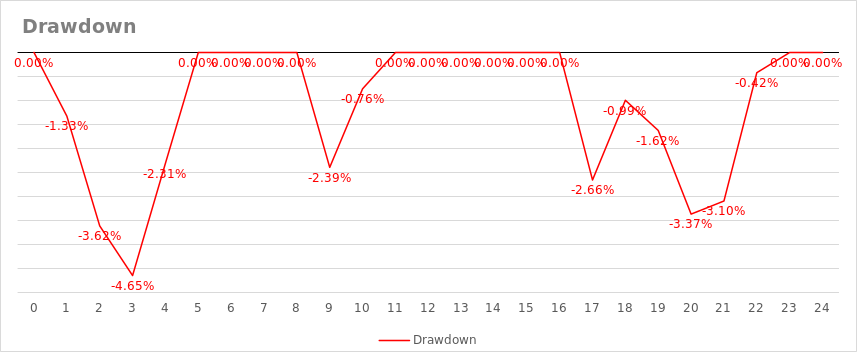

Here's the drawdown chart:

Pretty happy with that. I haven't cracked -5% in 2 years.

The best thing? It takes me 15 minutes a month to follow this portfolio. All I do is log in to Allocate Smartly, check the changes, log in to my broker account, get my current $ values of instruments I'm holding, input them in spreadsheet which tells me if I need to buy or sell, and put any orders on if needed to rebalance.

Conclusion

I've found a way to invest the bulk of my savings, that suits my current needs. 15 minutes a month, based on systematic strategies with statistical backtesting I can dive into to keep me interested, and it's scalable - if I get the trading bug again, I could dedicate some money and time into the paid subscription which will open a whole bunch of other portfolio options. 8.48% annualised return is not bad at all. The backtested model is claiming a max drawdown of -10.3% back in 1998 (or more recently -6.2% in Feb 2020). My drawdowns seem to track pretty closely to the reported figures. This tracking has given me confidence.

Some would say this is pretty black-box type trading/investing, and yeah I tend to agree, though I have chosen to trust Allocate Smartly, and do my own tracking to ensure I'm not off the rails.

I love the Amibroker software and building and coding systematic trading strategies, though I've accepted I can't dedicate the time required to make decent, stable, long-term returns.

For now, I've found something that works for me, with 2 years of tracked success. Happy days.